Binance is one of the world’s largest and most popular cryptocurrency exchanges, providing a platform for users to trade a vast array of digital assets. Understanding how Binance trading works in real scenarios involves exploring the practical steps traders take to buy, sell, and manage cryptocurrencies on this platform.

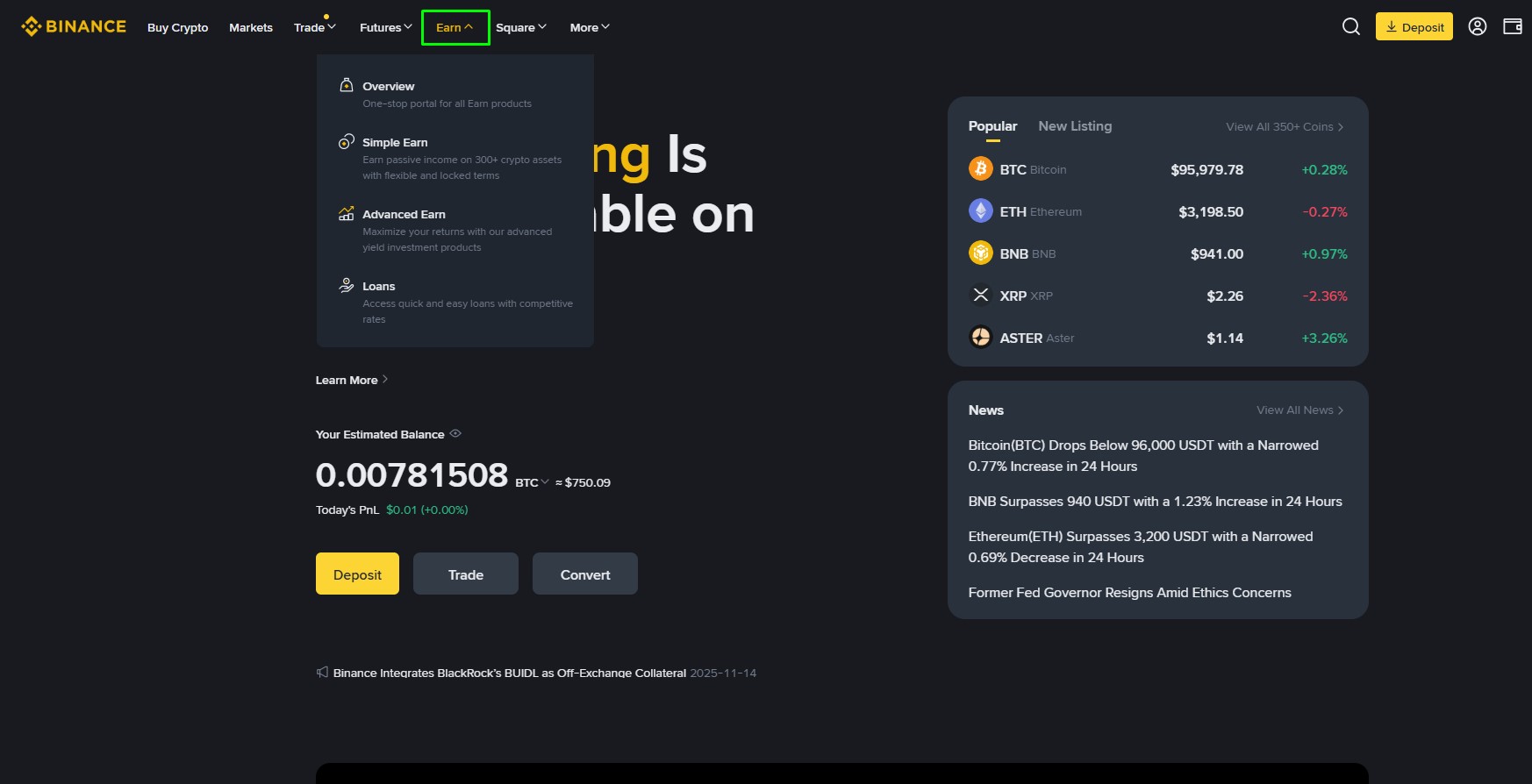

When a user first decides to trade on Binance, they start by creating an account and completing necessary verification processes. Once registered, they deposit funds into their Binance wallet. These funds can be fiat currency like USD or EUR via bank transfers or credit cards, or cryptocurrencies transferred from other wallets. The deposited assets form the base capital that traders use for transactions.

In real trading scenarios, how users typically interact with platforms navigate to the Binance spot market where most straightforward buying and selling occur. The interface displays various trading pairs such as BTC/USDT (Bitcoin/Tether), ETH/BTC (Ethereum/Bitcoin), among others. Traders select a pair depending on which asset they want to buy or sell relative to another asset.

A typical trade begins with analyzing market conditions using tools available on Binance’s platform such as price charts, order books, and recent trade history. Traders decide whether they want to place a market order-executed immediately at current prices-or limit orders that execute only when the price reaches a specific level set by them.

For example, if someone believes Bitcoin’s price will rise soon but wants to purchase it at a lower rate than currently offered, they place a limit buy order below the current market price. If the market dips down to this level during trading hours, their order fills automatically; otherwise it remains open until canceled or fulfilled.

Binance also supports advanced features like stop-limit orders which help manage risk by triggering buys or sells once certain thresholds are met-crucial in volatile markets where prices fluctuate rapidly within minutes or seconds.

Once trades are executed successfully in these real-world situations, users monitor their portfolios through Binance’s dashboard showing balances and profit/loss metrics in real-time. Many traders combine manual strategies with automated bots connected via API keys provided by Binance for executing predefined algorithms without constant supervision.

Additionally, margin trading allows experienced users to borrow funds from Binance against their holdings thereby amplifying potential gains-and risks-in actual practice. Futures contracts enable speculation on crypto price movements without owning underlying assets directly but require careful management due to leverage effects involved.

Overall, navigating Binance’s ecosystem requires understanding its diverse functionalities tailored for beginners through experts alike while applying sound investment principles amidst dynamic cryptocurrency markets encountered daily worldwide. Real scenario usage highlights how combining technical analysis tools with strategic order placement facilitates effective participation in crypto trading using this robust global exchange platform.